What Are the New Tax Brackets for 2022-2023? Keep These in Mind When Filing Your Federal Income Taxes

The last three years have been exceptional in terms of federal tax rates and inflation as a result of the COVID-19 pandemic. To this day, the entire world is still dealing with the effects of the widespread lockdowns that happened in 2020. A lot of the rising prices you’re seeing in grocery stores have been caused by global shortages and low staffing in industries across the globe.

That being said, every year the IRS adjusts more than 60 tax provisions in the U.S. to account for inflation. And in a year with consistently climbing inflation, this is imperative to prevent bracket creep, which occurs when people are either pushed into higher income tax brackets or have reduced value from credits and deductions due to inflation. In short, the IRS protects people whose living costs have risen without any increase in real income.

In this article, we’re going to look at the new federal tax brackets for tax season 2023 so you can be better prepared when filing your federal and Colorado tax return for this year and beyond. We’ll also cover how you can incorporate professional tax services into your finance toolkit to make filing for both business and personal taxes much simpler in the coming years.

How Federal Tax Brackets 2023 Work

The IRS used to use the Consumer Price Index (CPI) as a measure of inflation prior to 2018. However, with the Tax Cuts and Jobs Act of 2017, the IRS now uses the Chained Consumer Price Index to adjust income thresholds, deductions, and credit values. For more information on how the IRS has adjusted tax rates over the years, you can check out this page on their site that dates back to 2017.

Here’s what the IRS has to say about tax season 2023:

“The Inflation Reduction Act extended certain energy-related tax breaks and indexed for inflation the energy efficient commercial buildings deduction beginning with tax year 2023. For tax year 2023, the applicable dollar value used to determine the maximum allowance of the deduction is $0.54 increased (but not above $1.07) by $0.02 for each percentage point by which the total annual energy and power costs for the building are certified to be reduced by a percentage greater than 25 percent. The applicable dollar value used to determine the increased deduction amount for certain property is $2.68 increased (but not above $5.36) by $0.11 for each percentage point by which the total annual energy and power costs for the building are certified to be reduced by a percentage greater than 25 percent.”

Changes Happening in Revenue Procedure for the Years 2022-2038

The following information has been pulled directly from the IRS website. The tax year 2023 adjustments described below generally apply to tax returns filed in 2024. The tax items for tax year 2023 of greatest interest to most taxpayers include the following dollar amounts:

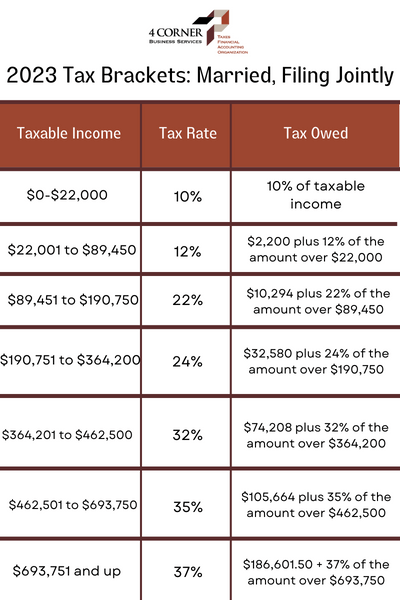

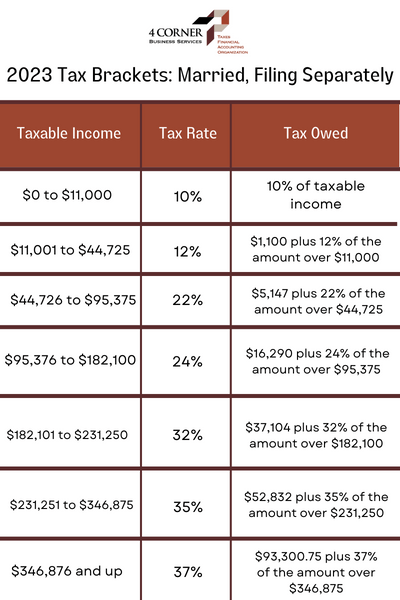

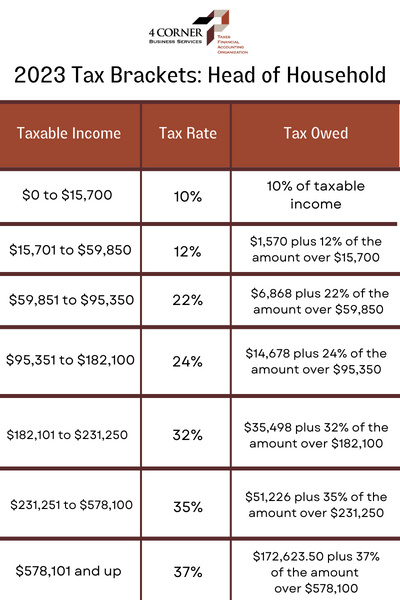

- The standard deduction for married couples filing jointly for tax year 2023 rises to $27,700 up $1,800 from the prior year. For single taxpayers and married individuals filing separately, the standard deduction rises to $13,850 for 2023, up $900, and for heads of households, the standard deduction will be $20,800 for tax year 2023, up $1,400 from the amount for tax year 2022.

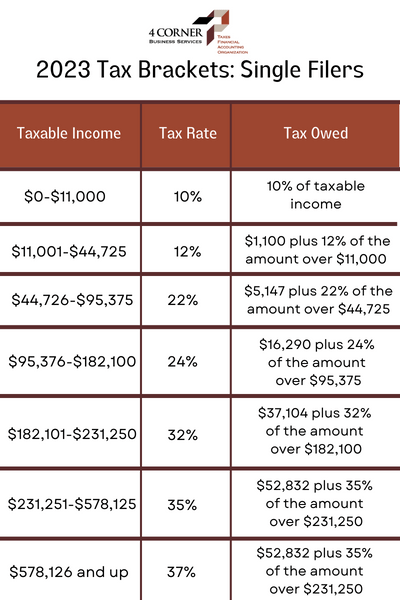

- Marginal Rates: For tax year 2023, the top tax rate remains 37% for individual single taxpayers with incomes greater than $578,125 ($693,750 for married couples filing jointly).

- The lowest rate is 10% for incomes of single individuals with incomes of $11,000 or less ($22,000 for married couples filing jointly).

- The Alternative Minimum Tax exemption amount for tax year 2023 is $81,300 and begins to phase out at $578,150 ($126,500 for married couples filing jointly for whom the exemption begins to phase out at $1,156,300). The 2022 exemption amount was $75,900 and began to phase out at $539,900 ($118,100 for married couples filing jointly for whom the exemption began to phase out at $1,079,800).

- The tax year 2023 maximum Earned Income Tax Credit amount is $7,430 for qualifying taxpayers who have three or more qualifying children, up from $6,935 for tax year 2022. The revenue procedure contains a table providing maximum EITC amount for other categories, income thresholds and phase-outs.

- For tax year 2023, the monthly limitation for the qualified transportation fringe benefit and the monthly limitation for qualified parking increases to $300, up $20 from the limit for 2022.

- For the taxable years beginning in 2023, the dollar limitation for employee salary reductions for contributions to health flexible spending arrangements increases to $3,050. For cafeteria plans that permit the carryover of unused amounts, the maximum carryover amount is $610, an increase of $40 from taxable years beginning in 2022.

- For tax year 2023, participants who have self-only coverage in a Medical Savings Account, the plan must have an annual deductible that is not less than $2,650, up $200 from tax year 2022; but not more than $3,950, an increase of $250 from tax year 2022. For self-only coverage, the maximum out-of-pocket expense amount is $5,300, up $350 from 2022. For tax year 2023, for family coverage, the annual deductible is not less than $5,300, up from $4,950 for 2022; however, the deductible cannot be more than $7,900, up $500 from the limit for tax year 2022. For family coverage, the out-of-pocket expense limit is $9,650 for tax year 2023, an increase of $600 from tax year 2022.

- For tax year 2023, the foreign earned income exclusion is $120,000 up from $112,000 for tax year 2022.

- Estates of decedents who die during 2023 have a basic exclusion amount of $12,920,000, up from a total of $12,060,000 for estates of decedents who died in 2022.

- The annual exclusion for gifts increases to $17,000 for calendar year 2023, up from $16,000 for calendar year 2022.

- The maximum credit allowed for adoptions for tax year 2023 is the amount of qualified adoption expenses up to $15,950, up from $14,890 for 2022

Items Unaffected by Indexing

By statute, certain items that were indexed for inflation in the past are currently not adjusted. The personal exemption for tax year 2023 remains at 0, as it was for 2022, this elimination of the personal exemption was a provision in the Tax Cuts and Jobs Act.

- For 2023, as in 2022, 2021, 2020, 2019 and 2018, there is no limitation on itemized deductions, as that limitation was eliminated by the Tax Cuts and Jobs Act.

- The modified adjusted gross income amount used by joint filers to determine the reduction in the Lifetime Learning Credit provided in § 25A(d)(2) is not adjusted for inflation for taxable years beginning after December 31, 2020. The Lifetime Learning Credit is phased out for taxpayers with modified adjusted gross income in excess of $80,000 ($160,000 for joint returns).

Can I Get Into a Lower Tax Bracket and Pay a Lower Federal Income Tax Rate for Tax Season 2023?

Yes, you can! There are two ways of reducing your tax bill:

- Credits. Tax credits can reduce your tax bill and they don’t affect what tax bracket you’re in. Here’s some documentation from the IRS on tax credits and deductions for your individual federal and Colorado tax return.

- Deductions. Tax deductions reduce how much of your 2022 income is subject to taxes. Deductions lower your taxable income by the percentage of your highest federal tax bracket 2023. Take all the tax deductions you can, as they can reduce your taxable income, placing you into a lower federal tax bracket.

If you’re interested in reducing your tax bill in the future, feel free to contact us a 4Corner Business Services. Our team of accounting and tax experts can professionally tune both personal and business taxes so you aren’t stuck in a tax bracket you don’t belong in.

Ready to Get Tax Season 2023 Over With? 4Corner Business Consulting Services in Denver, CO Can Help

4Corner Business Services is Denver’s answer to professional tax services. 4Corner’s team of experienced accounting and bookkeeping experts provide you with the business financial consultants you need to conquer tax season 2023. From keeping you up to date on federal tax bracket changes to filing your Colorado tax return, 4Corner’s business tax services are key to navigating tax season stress free. In addition to providing bookkeeping services for small businesses & large businesses, 4Corner offers payroll help, support in choosing & using accounting software, and business financial consulting.

We can provide you with comprehensive, professional tax services so you can better understand your personal or business finances and maximize your profit potential. At 4Corner Business Services, we are the experts who help you understand what financial services you need. If you have any additional questions, feel free to contact us at 4Corner Business Services. You can set up a meeting with Phil Zavala, founder of 4Corner, to get you on the right track.